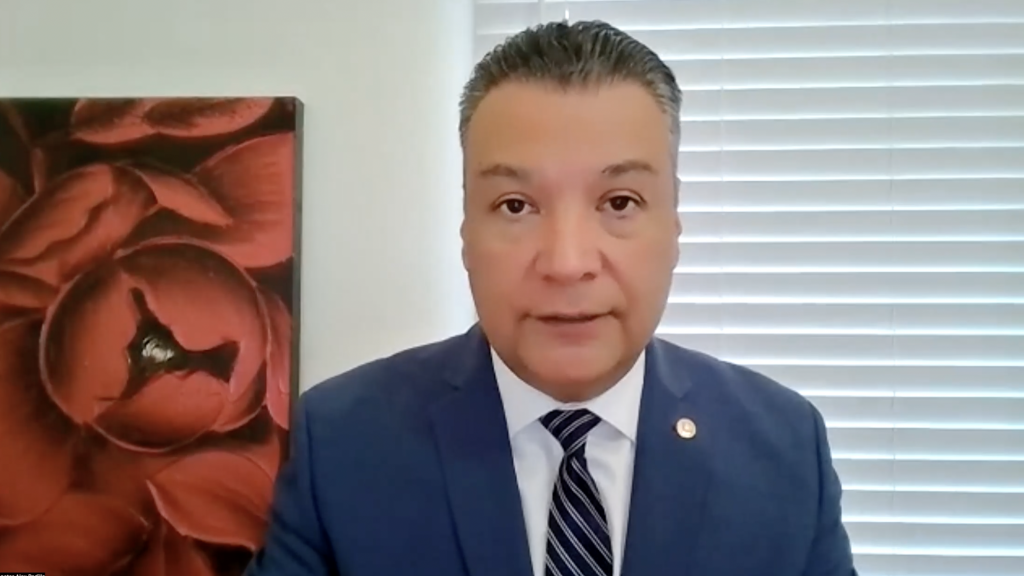

WATCH: Padilla Hosts Virtual Tax Event to Highlight Resources for Californians Impacted by Winter Storms

CALIFORNIA — Today, U.S. Senator Alex Padilla (D-Calif.) hosted a virtual tax filing roundtable with Golden State Opportunity and United Ways of California to help Californians prepare for the upcoming tax filing season. Following the wave of severe winter storms in recent months, most Californians are eligible to file their state and federal taxes as late as October 16, 2023, and claim disaster-related losses.

“This winter has been relentless for most Californians, with storms tragically taking the lives of loved ones and causing billions in damage to our communities. The last thing on people’s mind while recovering from a natural disaster is filing their taxes,” said Senator Padilla. “To help alleviate some of the hardship for those impacted, the IRS has extended the tax filing deadline to October 16, 2023 for individuals, families, and businesses in 51 out of 58 California counties. There are many changes this tax season, and I encourage all Californians to take advantage of all federal, state, and local resources available to them.”

“We urge everyone to file their taxes so that they claim every dollar they deserve. And they don’t have to pay to file—free tax prep help is available. We thank Senator Padilla for helping us reach more communities today,” said Sabrina de Santiago, Golden State Opportunity.

“United Ways across California help families file their taxes for free via Volunteer Income Tax Assistance (VITA) services. The stories of how meaningful tax credits can be for a family struggling to afford the cost of living are incredible. With a larger tax refund, families can get caught up on back-due rent, repair the family car, and invest in their children’s education. We encourage all Californians to learn about free filing options at myfreetaxes.org,” said Pete Manzo, President and CEO of United Ways of California.

Senator Padilla discussed new federal tax incentives that Democrats passed in the Inflation Reduction Act, including tax credits, rebates, clean energy incentives, and other benefits for businesses and individuals. This includes extending the American Rescue Plan’s subsidies that helped 1.8 million Californians access and retain health insurance coverage during the COVID-19 pandemic. Without an extension of these premium subsidies, an estimated 220,000 Californians could have been priced out of coverage, and nearly one million low-income Californians would have seen their premium costs double.

The webinar also included information on how Californians can take advantage of state funded workshops to learn more about filing their taxes, including how to avoid scams, where to get free filing assistance, and what materials are needed to file this year. You can view Golden State Opportunity’s presentation HERE and United Ways of California’s presentation HERE.

Watch the full webinar HERE and download it HERE.

###